服务承诺

资金托管

资金托管

原创保证

原创保证

实力保障

实力保障

24小时客服

24小时客服

使命必达

使命必达

51Due提供Essay,Paper,Report,Assignment等学科作业的代写与辅导,同时涵盖Personal Statement,转学申请等留学文书代写。

51Due将让你达成学业目标

51Due将让你达成学业目标 51Due将让你达成学业目标

51Due将让你达成学业目标 51Due将让你达成学业目标

51Due将让你达成学业目标 51Due将让你达成学业目标

51Due将让你达成学业目标私人订制你的未来职场 世界名企,高端行业岗位等 在新的起点上实现更高水平的发展

积累工作经验

积累工作经验 多元化文化交流

多元化文化交流 专业实操技能

专业实操技能 建立人际资源圈

建立人际资源圈美国作业代写:The difference of financial management between China and Western countries

2017-12-14 来源: 51due教员组 类别: Paper范文

下面为大家整理一篇优秀的paper代写范文- The difference of financial management between China and Western countries,供大家参考学习,这篇论文讨论了中西方财务管理的差异。西方企业因其产权法律制度和公司法律制度健全,在财务上实行统一法人管理体制。而我国的国有企业,财务管理权力严重分散,形成了总部和分支机构不同层面的财务主体,这就造成权衡收益和风险的价值观念不同。西方企业由于具有完整的产权约束机制;我国企业则缺乏审查的理财观念,对自身的盈利能力缺乏清醒的判断,国有企业虚盈实亏、效益下降,终将导致财务风险。

In China's traditional economic structure, public ownership is almost the only form of ownership. After the reform and opening-up, our country has established the ownership structure which takes the public ownership as the main body, the various economic components coexist, so the country always is the unification of the owner and the ruler. On the one hand, it establishes the tax system with the political power, and on the one hand establishes a macro-financial system by the owner's power, which can make clear and detailed stipulations on the distribution of after-tax profits. The Western countries ' ownership decide that the government itself does not have the identity of the owner of the means of production, so it is impossible to perfect a macro financial system, and it is impossible to make a rigid or specific provision for the distribution of after-tax profits.

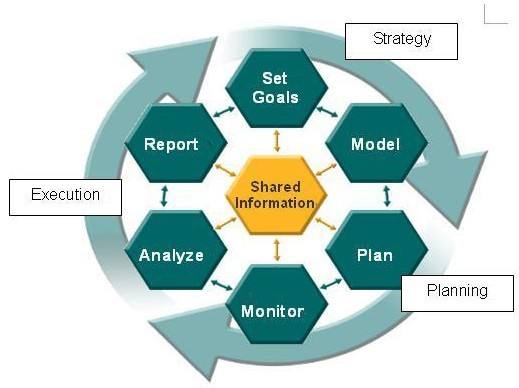

Micro-finance, refers to corporate finance. The differences of financial management in Chinese and Western enterprises are embodied in the characteristics, concepts, contents, understandings and organizational forms of financial management in five aspects:

Western financial management mainly focuses on the maximization of the market value of the enterprise, taking financial market as the main environment, taking stock, bond and other common financial instruments and derivative financial instruments as the means of financial operation. The theory of principal is regarded as the core concept and core theory of financial theory system in China. The principal is the premise and starting point of the financial theory, application theory and development theory, that is, the logical starting point of financial theoretical research.

The concept of financial management mainly from the financial objectives and the environment two aspects. First of all, the concept of financial entity is different. Because of the legal system of property right and the legal system of the company, the Western enterprises implement the unified legal person management system in finance. China's state-owned enterprises, the financial management power is seriously dispersed, forming the headquarters and branches of different levels of financial entities; then, the value of the trade-off between income and risk is different. The Western enterprise has the complete property right restraint mechanism, the Chinese enterprise lacks the regretful financial concept, the own profit ability lacks the sober judgment, the state-owned enterprise profits, the benefit decline, eventually causes the financial risk.

The Western Enterprise Finance forms the modern financial management theory system which takes the long-term financial management goal as the core, the modern financial management method system which is based on the capital budget, the cash budget, the financing decision, the investment decision, the dividend decision-making, so it has the close and direct connection with the outside world, is the outward The content of Chinese enterprises' financial management is restricted by its autonomy, which is inward-looking management, including capital Management, cost management and financial revenue management.

Different understandings of financial management. The domestic financial management's understanding mainly refers to the internal financial decision and the financial control system, mainly emphasizes the research listed company, also must study the group finance, the limited liability company finance, the small and medium-sized enterprise. The Western understanding of financial management mainly refers to the corporate finance, mainly to the capital market, to the listed companies such a special enterprise group, the special environment to study the company's financial objectives, financial tools and the value of financial evaluation issues.

Financial management is organized differently. The accounting and finance of the Western enterprises are completely separate, the CFO under the financial chief and the Treasurer, the former management of the financial institutions, responsible for reasonable financing and investment, the latter management accounting institutions, responsible for recording, collating and providing financial information. The accounting and financial institutions of Chinese enterprises are merged together, and the accounting institutions under the leadership of the chief accountant are responsible for the financial and accounting work. This is because the content of "inward" financial management is closely related to the content of accounting.

The difference of financial management between China and the West comes from the macroscopic and microeconomic environment with different financial management, the main reasons are as follows:

Although China's private enterprises have increased greatly since the reform and opening-up, the proportion of state-owned enterprises is still very large, not the private enterprise under the western ownership. As the owner of the enterprise, the state can dominate the business activities of the enterprise by the owner's power, so under the socialist planned economy, China has a macro financial system which regulates the behavior of the enterprises. Under the condition of market economy, macroscopic finance still needs to exist. Different ownership, financial content, system is different.

This is the root cause of the difference of financial management between Chinese and western enterprises. In our country, mainly by the State responsible for enterprises with the outside world, the enterprise basically does not have the financing problem, also has no right to decide the investment and profit distribution, it is impossible to set up a set of enterprises self-financing, independent management, self-financing, the distribution of the perfect micro-financial management theory and methodology system, and only incomplete management content Lack of export-oriented management content. This "lack" depends on the country detailed macroscopic financial system plan management to make up, therefore the enterprise financial management in the operation does not have the obvious insufficiency. Western enterprises can not rely on the planning management system, can only raise capital in the capital market or adopt various ways to borrow money, in the analysis of the cash flow of investment projects, investment return rate, the time value of capital, investment risk under the premise of investment decision-making, in favor of the development of enterprises under the conditions of

The system of Chinese enterprises is not perfect because of the late implementation of stock and bond system. And for most enterprises, there is no issue of raising and transferring stock and bond in financial management, and there is no dividend policy. In addition, there are a number of enterprises are owned by the whole country, the profit distribution should be carried out according to the relevant laws and regulations of the State, so there is no substantial content in after-tax profit distribution.

Western companies can raise money through a variety of financing channels in the development of a more comprehensive capital market, and individuals or businesses with idle funds can sell them in the capital market. Chinese enterprises are mostly funded by the state or collective, the implementation of "transfer loans" after the enterprise from the bank loans must also be submitted to the State for approval, otherwise it is difficult to get a loan. Or, enterprises do not have the need for financing and the market, so the financial management of enterprises there is no substantial content of financing, just to the state to seek funds, to the bank to obtain loans.

With the scientific and internationalized development of financial management, more and more enterprises have gradually shown the following development trends:

The era of knowledge economy has created favorable conditions for the international operation of Enterprises. As the knowledge capital is easier to transfer across borders, and the development of information technology makes the space relatively small, the economic links between countries become more and more close, so the enterprise management presents the globalization characteristic. Therefore, enterprises must establish the concept of global financial management, the world market, financial operations, improve the efficiency of financial management.

Corporate financial means and methods to network finance mainly, and network finance into the enterprise resource planning system. In the network financial environment, all economic activities of enterprises can be reported in real-time, facilitate the enterprise on-line management, improve the efficiency of the enterprise, and optimize the allocation of resources. More important is to speed up capital turnover speed, reduce the cost of enterprise capital, but the network finance is only a part of the Enterprise management Information System, only to integrate it into the enterprise resource planning system can fully play its role.

The financial risk management and the financial Safety management, the venture capital management will become the important content of the financial management. "Innovation" will be the main driving force of economic development in the future, and venture capital is an important problem to be faced by enterprises.

First of all, to find out the outside scientific and technological innovation, to conduct a preliminary screening and form the enterprise's technology introduction; or the independent organization of scientific and technological innovation activities will constitute the focus or starting point of enterprise financial management, the support of scientific and technological innovation and the use of its results will become the new center of Financial Management Therefore, the quality and efficiency of financial management and the force of the operation process are improved.

Because the future environment and content of financial management become more complicated, and the enterprise expands the enterprise scale further, the core position of financial management is more prominent in enterprise management, so the financial management organization should be set up in the enterprises to specialize in financial management.

To realize that market economy is legal economy, without law as a means to standardize market, market economy cannot develop stably and orderly. Therefore, whether it is the macro-allocation, management and supervision of state-owned assets, or the macro-management of the micro-finance of enterprises, we must emphasize the legalization and the foundation of legislation.

In financing, we should be inclined to bond financing, in the financing process, less to consider the actual financial needs of enterprises, in-depth consideration of the development requirements of enterprises. Improve the efficiency of enterprise funds utilization, so that the financial leverage of bond financing is fully utilized. In the scope of business development and market development, but also to vigorously improve the competitiveness of products. In the distribution of profits, the gradual substitution of cash dividends for the issuance of corporate profits, not only increase investor confidence, but also improve the efficiency of capital utilization.

To realize the importance of maximizing enterprise value, in its development process, more attention to the long-term interests of enterprises and future development. From a global perspective to the dynamic strategic vision of the enterprise financial management decision-making in the enterprise has formed a set of capital budget, cash budget, fund-raising decision, investment decision-making and dividend distribution decision-making, including the enterprise financial Management System to guide the development of enterprises.

51due留学教育原创版权郑重声明:原创paper代写范文源自编辑创作,未经官方许可,网站谢绝转载。对于侵权行为,未经同意的情况下,51Due有权追究法律责任。主要业务有essay代写、assignment代写、paper代写服务。

51due为留学生提供最好的paper代写服务,亲们可以进入主页了解和获取更多,paper代写范文 提供美国作业代写服务,详情可以咨询我们的客服QQ:800020041。