服务承诺

资金托管

资金托管

原创保证

原创保证

实力保障

实力保障

24小时客服

24小时客服

使命必达

使命必达

51Due提供Essay,Paper,Report,Assignment等学科作业的代写与辅导,同时涵盖Personal Statement,转学申请等留学文书代写。

51Due将让你达成学业目标

51Due将让你达成学业目标 51Due将让你达成学业目标

51Due将让你达成学业目标 51Due将让你达成学业目标

51Due将让你达成学业目标 51Due将让你达成学业目标

51Due将让你达成学业目标私人订制你的未来职场 世界名企,高端行业岗位等 在新的起点上实现更高水平的发展

积累工作经验

积累工作经验 多元化文化交流

多元化文化交流 专业实操技能

专业实操技能 建立人际资源圈

建立人际资源圈Assignment代写:The nature of the subprime crisis

2018-09-27 来源: 51due教员组 类别: 更多范文

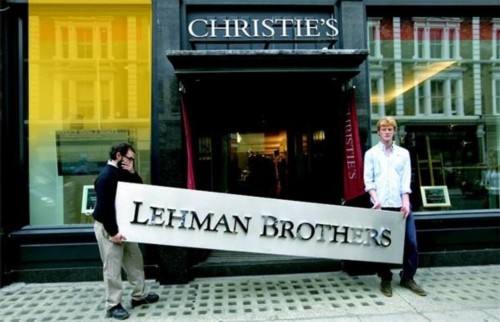

下面为大家整理一篇优秀的assignment代写范文- The nature of the subprime crisis,供大家参考学习,这篇论文讨论了次贷危机的性质。次贷危机是世界经济发展进程中不可避免的产物,其必然性是,在世界金融发展的现阶段,全球金融体系已经发生了根本改变,债券市场取代了传统银行的信贷功能,并繁衍出了各种新的金融工具。所以次贷危机实际上也提出了混业经营下的金融监管问题,次贷危机的爆发实际上是对现有金融监管理念的挑战。

The gradual spread and evolution of the subprime crisis into a global financial crisis is the result of long-term accumulation of contradictions under the existing international financial system and has profound historical influence. In terms of the history of finance, the us financial system has changed fundamentally, and the traditional banking system has given way to the rapid development of the bond market. Under the background of rapid development of bond market and replacing the dominant position of traditional Banks, the deep cause of the outbreak of subprime mortgage crisis lies in the persistent global economic imbalance and a large number of rapid and aggressive financial innovations generated by the reform of financial regulation. The direct reason is that after entering the interest rate hike cycle, the falling housing prices in the United States make the subprime borrowers less solvent, leading to the decline in the price of subprime bonds, and thus causing the pricing disorder in the bond market.

In February 2007, the subprime mortgage crisis surfaced and began to spread. The global financial market experienced a huge shock, and the subprime mortgage crisis has become the top enemy of the central Banks of major countries. So far, central Banks have shown strong resolve to rescue the crisis by joining forces to rescue the market. So can central Banks' co-operation prevent the subprime crisis from spreading further? We believe that the analysis of the nature and causes of the subprime crisis based on the history of financial development may provide some basis for the above judgment.

There are two turning points in the world's financial history. First, during the great depression of 1930s, the United States introduced the New Deal of Roosevelt to fully regulate the financial industry. Second, after the end of 1970s, Britain and the United States pushed for financial liberalization and reform, and financial regulation was constantly relaxed. At present, we are still in the era that defines the latter, the characteristics of this era is the traditional banking system in the rapid development of financial markets, to avoid regulation and produced a variety of financial innovation, financial regulation is to relax, and ultimately to the modern financial service act was enacted in 1999, confirmed the fact that financial mixed management.

To understand the current stage of financial development, we need to analyze two problems. First, in the process of financial liberalization reform, why non-bank financial institutions play a significant role and bond market has witnessed rapid development. The second is what has changed in the form of the financial crisis in the wake of these changes.

In 1971, when the bretton woods system broke down, the western countries entered a period of stagflation. As the main medium of household deposits and corporate lending, the banking industry is also subject to the Q regulations and the separate operation system. Under the stagflation environment, the market interest rate rises significantly, resulting in a large number of bank deposits flowing into the securities market, resulting in the phenomenon of financial intermediary disintermediation. At the same time, a large number of financial innovation tools have been created, which lays the foundation for the great development of the bond market.

After the 1980s, the financial liberalization reform in the United Kingdom, the United States and other countries began to relax financial regulation, carry out structural reform and improve the degree of competition in the financial system. Compared with Banks, non-bank financial institutions are less subject to supervision. Financial deregulation makes it more convenient to raise funds through the bond market, which results in the balance between bank loans and bond financing. The former gradually gives way to the latter. The trigger for the great bond market development came in 1979, when the federal reserve sharply raised interest rates in order to curb inflation and implemented a strong dollar policy, which started the great development of the U.S. bond market. On the one hand, high interest rates caused countries' dollar reserves to flow back to the United States and buy dollar assets, especially Treasury bonds or bonds with government credit guarantee. On the other hand, in 1983, the United States proposed the "Reagan recovery" strategy, which tripled the national debt and reached $3 trillion in 1989. This fundamentally changed the position of the bond market relative to the banking system and involved all countries in the us bond market system.

After analyzing the financial crisis since the 1980s, we found that except the stock market crisis in 1987 and 2000, other financial crises were caused by the bond market or the broader credit market, which was manifested as the crisis of the financial system. This is the inevitable result of the reform of the financial system.

The essence of financial system crisis is that while the bond market replaces the banking system as the main financing channel, it also transfers risks to the capital market and spreads to the whole financial system through capital market participants. With capital markets far less regulated than the banking system, the bond market crisis may be more of a threat than the traditional banking crisis. And because the bond market is dominated by institutional investors, especially the big global players, it is easy to magnify a crisis once it breaks out. As a result, the current form of financial crisis has undergone fundamental changes, from the traditional banking crisis to the bond market triggered by the financial system's overall crisis.

The development history of world finance shows that the outbreak of financial crisis is often the result of the long-term accumulation of economic and financial contradictions, and the subprime crisis is no exception.

Global imbalances are reflected in large current account deficits in some developed countries, particularly the us. Countries with inadequate savings, while many developing countries and some developed countries, such as Germany and Japan, have large current account surpluses and become surplus savers.

The global economic imbalance persists mainly because since the 1990s, the United States has become a major current account deficit country in the world by overdrawing its own credit and supporting its excessive consumption on a global scale. The us is able to overdraw its own credit for three reasons. First, the existing international financial system is still centered on the us dollar, which is the main reserve currency and payment instrument. After the collapse of the bretton woods system, dollar issuance was no longer restricted by gold reserves and production. Second, financial liberalization reform greatly deepened the domestic financial market in the United States. Sufficient liquidity and continuous innovation of financial instruments made the United States become the most developed country in the global capital market, attracting global capital inflow and rapidly increasing the wealth of American residents. Third, the United States remains the world's largest economy and the center of innovation in knowledge, technology and products. It has maintained a stable and relatively fast economic growth for a long time.

The extreme imbalances came after continued strong global economic growth fueled financial innovation, with many new financial instruments being developed to meet the needs of investors of all kinds, especially bond markets. On the one hand, countries with surplus savings have accumulated huge reserves of us dollars and need to maintain and increase value. Us dollar assets are the most important choice for them. With the increase of the scale of foreign exchange assets in these countries, their risk preference degree is also rising, which lays a hidden danger for the subprime mortgage crisis. On the other hand, the huge demand for securities assets keeps driving down market interest rates, stimulating domestic consumption and investment demand in the United States, the household savings rate keeps falling, and bond issuance expands sharply. However, this unbalanced growth model is unsustainable and will inevitably lead to a financial crisis that will take the economy to a rebalancing stage in extreme form.

Before the great depression, there was no modern financial regulation. The modern financial regulation system with "separate operation and separate supervision" as the core content was established after that, which maintained the stable operation of the financial system for nearly 30 years. By the 1970s, the world had begun the reform of financial regulation for more than 30 years. The main line of reform was from emphasizing market efficiency to emphasizing prudent management of financial enterprises. Financial innovation of the 70 s and avoid failure control makes some control measures, and the 80 s is under the condition of deregulation through legislation is not yet mature, a simplified financial regulatory organization as the change of compromise means, in the 90 s, the relaxation of financial regulation through legislation is ripe, and went to save the financial services modernization act.

The reform of financial regulation since 1970s includes two aspects: one is liberalization reform which mainly liberalizes financial market regulation; The second is to establish regulation of financial enterprises. After the financial market deregulation, due to the expansion of financial enterprises' business activities, the interest rate for financial enterprises increased from 1% to 5.25%. Then, the real estate price stopped rising in 2006 and began to gradually decline. Within a year, the housing price fell by 3.5%, the biggest decline since the great depression of 1930s. At this time, the interest rate adjustment to begin to fully show the influence of subprime borrowers, for new homebuyers, rising interest rates increase the cost of the loan, and for have buyers, on the one hand, the benchmark interest rate rise increase repayment pressure, on the other hand, the interest rate reset further makes its strain, and rising prices has slowed even formed new pressure then began to fall. So, rising benchmark interest rates and interest rates reset allows borrowers repayment costs rising sharply, and because of falling real estate prices, led to the fall in the value of the property as collateral, lead to a floating interest rate mortgage delinquencies and defaults rise obviously, and if these is in default or default of mortgage loans was eventually collect, will form the credit losses.

Specifically, as the monetary policy enters the interest rate hike cycle, the real estate price drops, causing the solvency of subprime borrowers to decline, failing to repay loan principal and interest on schedule, and the delinquency rate and default rate to rise. As a result, rating agencies began to downgrade bonds such as subprime mortgage bonds, causing their value to fall. Then, a large number of institutional investors began to get into trouble, and because of the need to avoid risk, the lenders that lent to these investors often demanded that they pay back the loans, these institutional investors were under great pressure at this time. However, the liquidity of the secondary market is basically lost due to the low liquidity of the bond market and the opaque pricing mechanism, as well as the lack of confidence in the market and the sharp rise in sensitivity to risks in the outbreak of the crisis. In this case, the impact would be threefold: first, to raise funds to adjust positions, investors would be forced to sell some high-quality, liquid bonds and stocks, which would implicate the prices of those with higher credit ratings; Secondly, based on the size and influence of the subprime bond market, the sharp decline in its price will cause the market to begin to doubt the market value of mortgage securities, including some senior bonds, leading to a significant decline in its price. Third, because leverage is used so much in the investment process, losses will be multiplied after the risk occurs. Based on the above mechanism and the globalization of subprime debt market, the subprime crisis in the United States gradually evolved into a global financial crisis.

From the perspective of history, the subprime crisis is an inevitable outcome in the process of world economic development and a milestone event in the history of world financial development.

The inevitability of the subprime crisis is that, at the current stage of world financial development, the global financial system has undergone fundamental changes, and the bond market has replaced the credit function of traditional Banks and multiplied various new financial instruments. In the imbalance of global economic system, the financial control relax the historical period, through to the returns and risk of decomposition, constantly created new derivatives constructs a very long "the financial system of the food chain", covering the global financial markets, and also transfer the financial risk in every corner of the world, to every corner of the financial markets. But too long a food chain makes the financial ecology extremely fragile, and the top of the food chain is in trouble that will break down the whole chain and spread to every single antenna, and now the top of the food chain is the United States and the American real estate industry.

At the same time, at the current stage of world financial development, virtual economy no longer exists as shadow of real economy, and the attention to virtual economy has already shifted from monetary stability and economic efficiency to improving the competitiveness of financial institutions, so the separate business model began to change into mixed business model. This shows that in the process of economic globalization, as the vertical integration of international division of labor continues to deepen, the function of the international financial system has changed, and has become the main tool for economic benefit redistribution in the global scope. However, the outbreak of subprime mortgage crisis shows that, due to the one-way vertical integration, this pattern is not sustainable, and various economic and financial contradictions will inevitably erupt when accumulated to a certain stage.

It can be argued that the subprime crisis in fact also raised the issue of financial supervision under mixed operation. Before the 1930s, the financial industry was mixed operation, but there was no financial regulation in the modern sense, that is to say, there was no precedent for regulation under mixed operation mode. However, the outbreak of the subprime mortgage crisis is actually a challenge to the existing financial supervision concept. "functional supervision" does not solve the financial supervision problem under the mixed operation mode. In other words, "functional supervision" is suitable as a concept, but it is difficult to be implemented in the financial practice. Treasury secretary Henry paulson has proposed a "target regulation" model, which should be said to be a useful exploration even if it does not solve the problem.

51due留学教育原创版权郑重声明:原创assignment代写范文源自编辑创作,未经官方许可,网站谢绝转载。对于侵权行为,未经同意的情况下,51Due有权追究法律责任。主要业务有assignment代写、essay代写、paper代写服务。

51due为留学生提供最好的assignment代写服务,亲们可以进入主页了解和获取更多assignment代写范文 提供美国作业代写服务,详情可以咨询我们的客服QQ:800020041。